MURRAY – Open enrollment for Medicare is in full swing. Between now and December 7, Americans aged 65 and older are tasked with deciding whether their healthcare needs will be best met under original Medicare or through a Medicare Advantage plan.

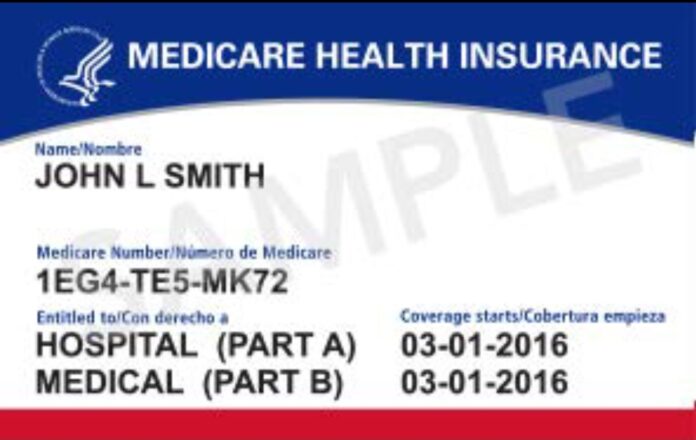

Medicare is an overwhelmingly complicated system. To understand the difference between the options available, it is important to know the basics of original Medicare. For the most part, people become eligible when they turn 65 years old. Original Medicare is broken down into two “parts” – one covering inpatient services (Part A) and another covering outpatient services (Part B). Original Medicare is almost universally accepted by providers across the country. It also does not require prior authorizations for medically necessary services.

Those who have worked at least 40 quarters (10 years) have paid into the system through payroll taxes and do not pay a premium for Part A coverage; notably, anyone not meeting the employment threshold is required to pay a premium.

Under Part A, patients pay a deductible per benefit period, which starts upon admission to a hospital or skilled nursing facility and ends 60 days after discharge. In 2024, the deductible is $1,632 (up from $1,600 last year). The deductible is not annual; it is possible to have more than one benefit period in a calendar year, which means a patient could have to pay it multiple times. Patients are responsible for 20% of charges after the deductible is met, and there is no cap on out-of-pocket expenses.

Seniors may enroll in Part B upon turning 65 or, if they are still working at that time, when they retire. In 2024, the monthly Part B premium will be $174.70 (up from $164.90 last year), and the annual deductible will be $240 (up from $226). Part B premiums are automatically withdrawn from social security benefits. Assistance with paying premiums is available to low-income households, while those with annual incomes above $103,000 ($206,000 if filing a joint tax return) pay higher premiums.

As with Part A, patients are responsible for 20% of charges after meeting the deductible, and there is no cap on out-of-pocket expenses. Dental, vision and hearing benefits are not available. Part B does not include prescription drug coverage; beneficiaries are required to enroll in a separate prescription drug plan (Part D) of their choice. Monthly premiums for those can range from $5-$100, depending on an individual’s routine prescription medications.

That is the first option. Paying the monthly Part B premium (and the Part A premium, if required) and purchasing a Part D plan is all that is required to avoid penalties. The problem with that option is that there are no out-of-pocket maximums with original Medicare, which leaves seniors vulnerable to financial ruin should they incur catastrophically high medical bills.

The second, and arguably the best, option is to purchase a Medicare supplement policy, commonly known as “Medigap” plans. Monthly premiums start at $94 for females and $117 for males, but they are subject to rate annual increases. Beneficiaries are still required to pay the Part B premium, and most will have to pay the Part B deductible; but the supplement covers Part A deductibles and the patient’s portion of charges on services (20%). Medigap policies do not cover dental, vision or hearing services, and seniors must purchase an additional prescription drug policy to be compliant with Part D requirements. Because these policies supplement original Medicare benefits, beneficiaries can receive services anywhere Medicare is accepted.

The third option is to forego original Medicare benefits and enroll in a Medicare Advantage plan, also known as Part C. These plans are alternatives to original Medicare that are serviced by private insurance companies. While the plans provide out-of-pocket maximums, they also restrict patients by using provider networks and requiring prior authorizations for many services.

Beneficiaries are still responsible for paying the Part B premium in addition to any premium for the Medicare Advantage plan, but most plans boast low monthly premiums, ranging from $0-$30. The Kaiser Family Foundation found that, in 2023, 73% of those enrolled in Medicare Advantage plans with prescription drug coverage paid no other premiums outside of the Part B premium.

Patients have copays on office visits and services, but most plans do not have deductibles. Often, prescription drug coverage (Part D) is packaged into Medicare Advantage plans, and often do not have deductibles on those either. Typically, plans include extra benefits not covered by original Medicare, such as dental, vision and hearing coverage.

A recent search on medicare.gov for Medicare Advantage plans with drug coverage included that are available to Calloway County residents in the 42071 zip code yielded 26 results. Out of those, there are 10 health maintenance organization (HMO) plans, which do not provide out-of-network coverage, and 16 preferred provider organization (PPO) plans, which allow out-of-network claims at higher costs to patients.

Eight of the 10 HMO plans have $0 premiums, and six plans do not have deductibles. Wellcare and AARP (UnitedHealthcare) each offer four HMO plans, Humana and Anthem each have one. The out-of-pocket maximums on those plans range from $4,500-$6,700, with the average being $4,860.

Looking at the PPO plans, 10 are offered by Humana; Anthem offers four, and UnitedHealthCare and Wellcare each offer one. Of the 16, seven have no premiums, five of which do not have deductibles either. Of those without premiums, the average out-of-pocket maximum for in-network services is $6,578, ranging from $5,400-$8,850; out-of-network out-of-pocket maximums range from $8,950 to $13,300, with the average being $10,778. Of the nine that do assess premiums, the average in-network out-of-pocket maximum is $6,077, ranging from $2,250-$8,850; for out-of-network services, out-of-pocket maximums range from $2,250-$13,300 and average $9,361.

Comparing all 26 plans, 85% have no copay for primary care visits, and copays for specialists range from $30-$45. Costs for services, such as lab work, x-rays or emergency room visits, can vary greatly. They all offer vision, dental, hearing, fitness, worldwide emergency and telehealth benefits; most, but not all, offer over-the-counter prescription benefits and many provide transportation.

On paper, Medicare Advantage plans may seem like the obvious choice for seniors as they provide out-of-pocket maximums along with extra benefits for low- to no-cost premiums. In reality, system-wide fraudulent practices, which have been well-documented, increase costs for patients and providers.

While Medicare Advantage plans are supposed to abide by the same reimbursement guidelines for services as original Medicare, insurers have come under intense scrutiny in recent years for denying prior authorizations as well as claims for medically necessary care that would have been paid by original Medicare. This is a problem for those on Medicare Advantage because, when claims are denied by the insurance company, patients are still responsible for medical bills incurred; in other words, patients are still responsible for paying the bills, but those payments do not count toward out-of-pocket maximums.

Looking locally, Murray-Calloway County Hospital CFO John Bradford said in an interview last year that, in fiscal year 2022, if all the patients the hospital treated on Medicare Advantage plans had been insured through original Medicare, the hospital would have earned an additional $5 million. Those kinds of losses are a significant concern to hospitals, as evidenced by the number of facilities and systems that are cancelling contracts nationwide.

Last week, Louisville Public Media reported that Baptist Health is currently trying to renegotiate contracts with UnitedHealthCare and Wellcare Medicare Advantage plans. If a deal cannot be reached before the current contracts expire on Dec. 31, the hospital system and its affiliated clinics will go out-of-network for those plans.

Seniors can explore their options for both health and drug coverage on their own by visiting the website medicare.gov. Insurance agents can also provide guidance and consultations are free. Agents have access to plan details, including provider networks, and can help seniors make decisions based on their specific needs.